Freelance Invoicing- What type of freelancer are you?

Translator? IT specialist? Product manager? Financial Specialist? Or A Graphic designer exhausted by your clients' endless "Maximize the logo" request?

Whoever you are, freelancing is your small business.

To keep and grow this business, you'll need a continuous income flow. Briefly, cash is the Oxygen of your business.

Even if you answered 'a financial expert' to my abovementioned question, streamlining the invoicing process will give you more space to concentrate on expanding your start-up business.

So, freelance invoicing is a critical pillar to ensure taking your freelancer career to the next step.

This write-up will give you some helpful hints on the invoice, how to write it, what to include, how to ensure getting paid on time, and a fantastic template to use.

What is the invoice?

The invoice is perhaps the essential thing for a freelancer to keep track of conveyed products or services. An invoice is vital for a freelancer to get paid, and it contains all data concerning an outsourcing task or a client project.

It isn't needed, in all cases, that the document is alluded to as a "receipt" in monetary exchanges. The invoice can be referred to as a receipt or a settlement sometimes.

Invoices can be printed or sent online if the recipient accepts. Accordingly, it should include subtleties for the expectations, money, freelancer, and client. In all cases, conveyance or different services are charged to a client on a receipt.

Why Should Freelancers Send Invoices?

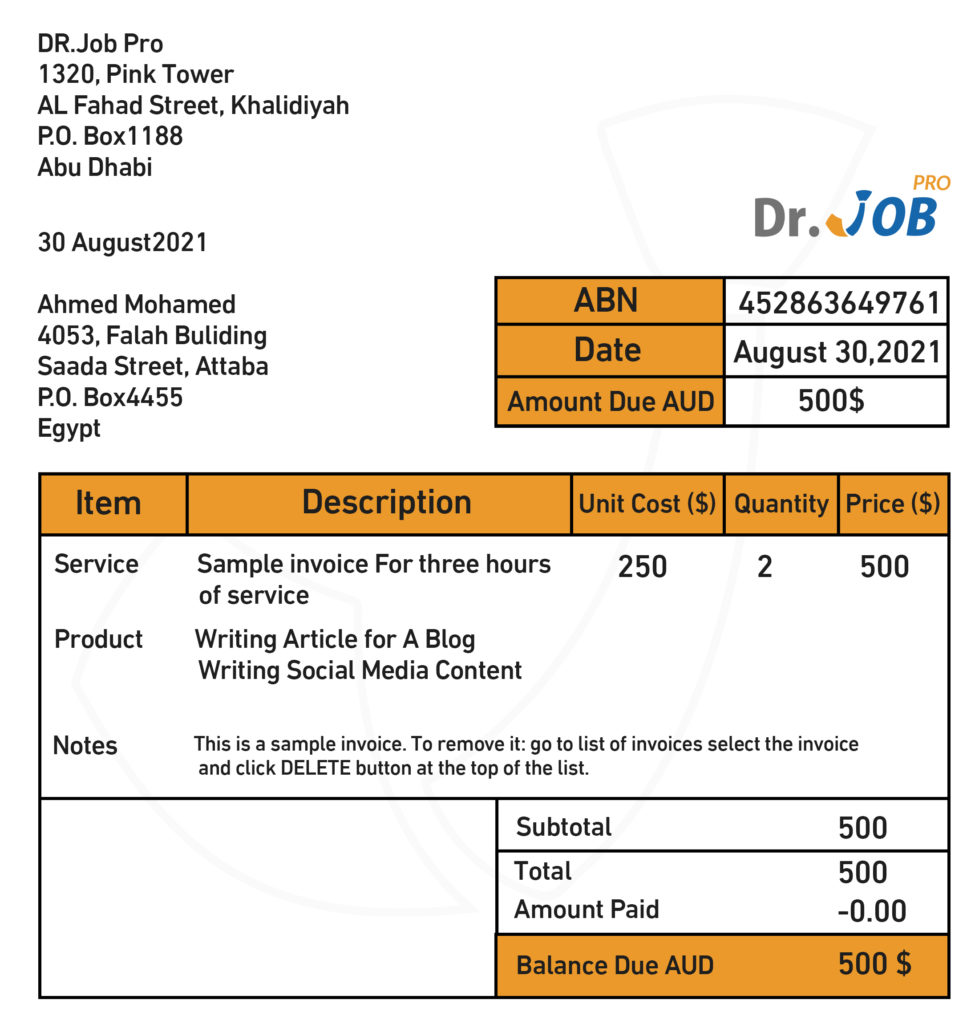

What to Include in Your Freelancing Invoice?

- The freelancer's name and address

- The project owner's name and address

- Invoice number and client number

- Invoice date

- The title of the document is INVOICE.

- Total price before taxes

- Description of the deliverables

- If applicable, value-added tax/discounts

- The total amount payable

- Payment terms

- Payment method

- Optional: additional notes

So, How Can Freelancers Ensure Getting Paid On Time?

Follow these effective freelance invoicing strategies.

Screen Your Clients

Other practical ways include: checking your client's social media accounts to verify his legitimacy, asking your freelance mates if someone has worked with the same client before, and listening to your heart; if you suspect the client for no reason, skip his page.

Send The Invoice On Time

So, it's a good idea to send your invoice as soon as you deliver your service or product.

You can wait until you receive positive feedback from the client or use automatic invoicing software to remind you to send out invoices.

Don't Let the Cash Go Away from You

You can avoid this by implying extra charges or additional fees in case of delay.

Although instant invoices are a good solution, you can add a "promise to pay" article in your contract, which obliges the client to pay in a specific time frame.

Invoice in Installments

On the other hand, you'll ensure receiving the due amount for every milestone you do, getting regular cash, and avoiding unexpected instances like client-ghosting.

Set Boundaries to The Client's Excuses

To avoid such excuses, you've to send upfront reminders. The online invoicing platforms are a great tool to do this automatically, or you can do it manually by using "FollowUpThen."

Clients who receive prompts are more likely to respond quickly. A further strategy is to offer a bonus for on-time payments, which encourages people to avoid apologizing and make the payments.

Your reminders should include a clear subject line, a summary of the due amount, payment method, and a CTA to urge the client to pay immediately.

Define Understandable Payment Conditions

Payment conditions must encompass everything, including the payment timeframe, methods, and extra charges to delay the amount.

Set comprehensive, manageable conditions. Write, for example, that payments will be made 1 month after receiving the product/ service.

Let Automation Do It for You

Technology will do it for you, but at some point, the human touch is critical. If you receive no reply from the client for an extended period, try to contact him personally to find the reasons behind his delay.

Take A Deposit

It will also safeguard you from being scammed. Before starting work, freelancers typically should take 25%-50% as a deposit.

Mix Your Promises and Threats

So, instead of being surprised with such unpredicted incidents, set a "promises and threats" plan.

For the promises, you can offer a discount on the total amount or offer an additional service for free, e.g., if you're a content writer, you can provide an extra "proofreading" service if the client pays the total amount on time.

You can apply the "late payment penalty " for the threats,'' which starts with a low amount and then increases over time. This progressive penalty will encourage the project owners to pay on time.

Diversify Your Payment Methods

It's essential to do your homework on payment methods because extra fees or terms could make the method unsuitable for you.

Consider the following payment methods:

Western Union: The sender is responsible for paying all the fees, making it a secure method of receiving funds. Nevertheless, it would be best to double-check that you have a nearby Western Union branch to receive your money.

Paypal: The receiver is responsible for paying all the fees. If you're utilizing this approach regularly, you might wish to add an extra charge to your statement to cover those costs.

Banks: Every bank has its transaction policy. So, you've to know more before asking the client to transfer the amount from outside your country.

Do It Manually

You'll find templates specially created for freelance translators, designers, executives, and more.

Hire A Freelance Accountant

It's a must if you live in a country where you've to pay tax for freelancing, as invoicing software can not help you in all tasks when calculating taxes.

Conclude A Contract

Your contract should include clear information on:

- Your rates (Hourly, Weekly, or Monthly)

- Project Deadline

- Late Payment or Cancellation Penalties

- Payment Methods

Be Decent

You can send notes like: Please, send the due amount before 8/9, or it was a pleasure collaborating with you, and I'm looking forward to receiving my due amount within this week.

Simultaneously, there will be instances where you should be more assertive. Sometimes and after repeated reminders, a client may refuse to pay a debt. In these situations, you should begin by sending emails and making calls.

If the client escapes from receiving your calls, you can hire a freelancer as a personal assistant to reach the client from his number and collect your money.

Let courts be your last resort.

Do you find these tips helpful? Do you've any other suggestions that may help other freelancers? Please share with us in the comments box below.

2022-08-29

2022-08-29

2022-05-25

2022-05-25

2022-04-11

2022-04-11

2022-03-17

2022-03-17

2022-02-25

2022-02-25